Strategy

Industry Breadth & Depth

Blue Wolf targets investment opportunities involving significant transformation where we can leverage our experience and capabilities in operational and commercial excellence, government relations, and human capital. Since 2005, we’ve developed deep experience and insights where these dynamics intersect within the healthcare and industrial sectors. Our commitment to agility, learning, and strong partnerships ensures we deliver long-term impact through a differentiated approach.

Healthcare: Services

Our investments in healthcare services are driven by the belief that opportunities abound for innovative approaches to deliver better care and improved outcomes at a lower cost, aligned with the “Triple Aim.” This fragmented sector — entwined in a complex web of regulators, providers, and payers — presents significant challenges but also offers the potential for meaningful growth. By partnering with clinicians, industry experts, and management teams who share our vision, we endeavor to address some of the most pressing challenges facing the U.S. and global healthcare landscapes and help our partners achieve measurable results.

Healthcare: Products & Devices

Healthcare products include medical devices, logistics, and operations management. The same Triple Aim philosophy that underlies our services investments drives our product-based investment portfolio — and our longstanding commitment to operational and commercial excellence helps us partner with management teams to equip frontline providers with the tools they need to deliver outstanding clinical outcomes.

Healthcare: Pharmaceutical Supply Chain

With great advances in drug therapeutics, the pharmaceutical supply chain — from development to manufacturing to distribution — is being reconfigured. Blue Wolf’s investments in this sector blend our deep background in manufacturing disciplines and global supply chain management with our attention to clinical outcomes to drive the growth and creation of market-leading organizations that meet the challenges of this rapidly changing sector.

Industrial: Building & Forest Products

Blue Wolf invests across the entire value chain of forest and building products — from upstream sawmills and paper mills to downstream manufacturers and distributors serving home improvement retailers, contractors, and home builders. Our success in this space stems from strong relationships with operators, unions, and industry experts throughout the supply chain. These partnerships provide us with unique insights that enable us to drive operational growth and environmental sustainability across the industry.

Industrial: Industrial & Engineering Services

With decades of experience as owners and operators of manufacturing facilities, we understand the critical role that best-in-class industrial and engineering service providers play in keeping machines running, trains moving, and pipes flowing. The teams building new factories aren’t just supporting their customers — they’re driving the next stage of growth and revitalizing domestic manufacturing. At Blue Wolf, we see complexities as opportunities to unlock value others might overlook.

Industrial: Niche Manufacturing

Blue Wolf focuses on niche manufacturing and distribution businesses where our core competencies make us ideal partners for management teams with defensible value propositions. Our investments span manufacturers and distributors across diverse sectors, including capital equipment, specialty ceramics, paper, and building products. We partner at pivotal moments, such as corporate carve-outs or ownership transitions, to foster sustainable growth and long-term success.

Distinct Value Add

Since our founding, Blue Wolf has focused on creating differentiated value in three key areas:

Complex Transactions

Commercial & Operational Excellence

Blue Wolf doesn’t take a passive approach to investments. We partner with companies to drive transformational change in environments marked both by risk and opportunity — because transformation is a skill.

It begins with defining a company’s current state, envisioning a future, and aligning on a clear, actionable strategy. Our investment team works hand-in-hand with seasoned operators to provide effective management support. We employ well-developed tools to optimize governance, cost structures, strategy, commercial and operational excellence, and relationships with employees and external stakeholders.

Labor & Human Capital

Working with Unions & Workers

Tens of thousands of people work at Blue Wolf portfolio companies — doing jobs from healthcare delivery and heavy manufacturing to senior executives and CEOs. Forging constructive relationships between employees and management is both good business and the right thing to do.

Over our twenty-year history, we have built comprehensive human capital capabilities, reflecting our commitment to creating value for all stakeholders. Our focus on respecting workers’ contributions has enabled us to build decades-long relationships with union leadership and align workers, management, and Blue Wolf across the portfolio.

Government Exposure

Navigating Regulators

Government and regulatory agencies often create opportunities through low-cost financing and incentives tied to public policy goals. However, they can also bring challenges, such as unpredictable cash flows and financing complexities. Blue Wolf helps businesses navigate these challenges with a deep understanding of regulatory environments and public policy imperatives, turning complexities into opportunities for growth.

By aligning companies with public initiatives, we seek to unlock government-driven tailwinds to foster sustainable growth.

Equity Investor

Blue Wolf primarily targets control equity positions in high-quality middle-market companies within niche industries across the industrial and healthcare sectors. We also welcome co-control investments with select partners, including investment funds, operators, independent sponsors, corporations, and family offices.

Whether investing independently or in partnership, we back businesses positioned to thrive through disciplined management, aligned incentives, an ESG-driven approach, and strategies designed to adapt to evolving markets and regulatory landscapes, driving transformational outcomes for our portfolio companies.

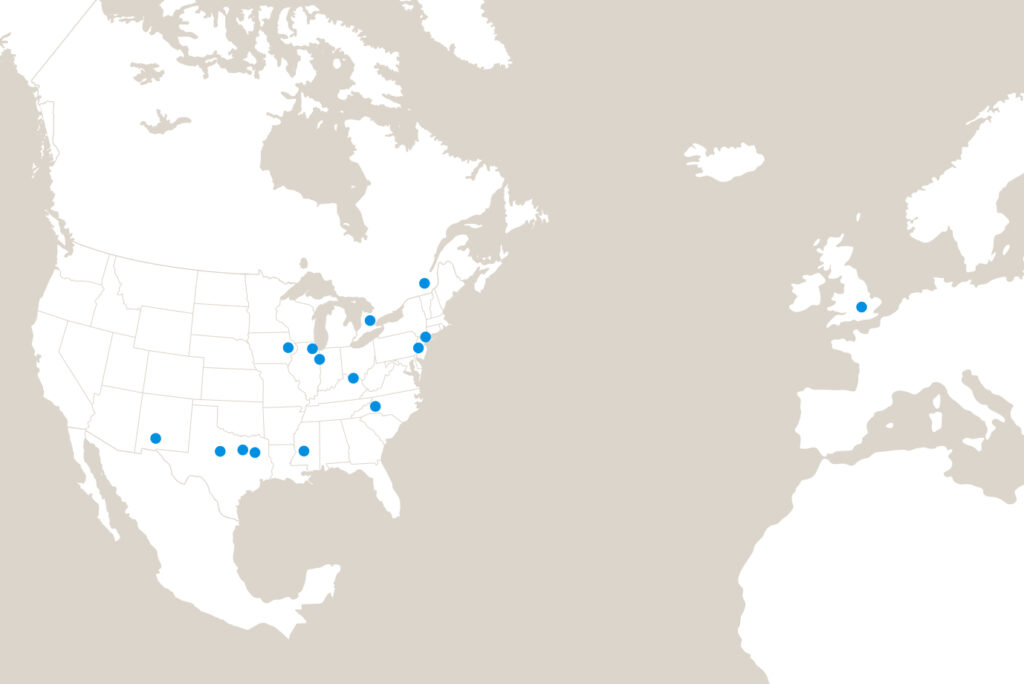

Geography

Blue Wolf primarily invests in platform companies headquartered in the United States and Canada, leveraging our ability to navigate diverse markets. We also selectively consider platform investments in Europe and global add-on acquisitions that align with our strategic objectives.

Size

Blue Wolf seeks to deploy meaningful capital in each portfolio company, aligning our investment size with strategic opportunities. Our typical investment parameters include:

$100+ million

Annual Revenue

$10+ million

EBITDA

$100 million — $1.5 billion

Enterprise Values

$75 million — $500 million

Equity Investment Required

For platform companies with well-defined growth or consolidation plans, we may consider smaller initial investments.